self employment tax deferral calculator

Ad Are You Suddenly Self-Employed. This is calculated by taking your total net farm income or loss and net business income or loss and.

How To Pay Tax On Self Employed Income Debitoor Invoicing Software

Tax deferral can help you grow your money faster since the value is not being reduced by annual income taxes each year.

. When does the deferred amount need to be repaid. Discover Helpful Information and Resources on Taxes From AARP. Net earnings from self-employment.

Lastly revisit the section for the Self-employment tax deferral entry. SmartAnswersOnline Can Help You Find Multiples Results Within Seconds. The self employed tax calculator is a quick tool based on Internal Revenue Code 1401 to help a freelancer or self-employed taxpayer to compute two taxes the Social Security.

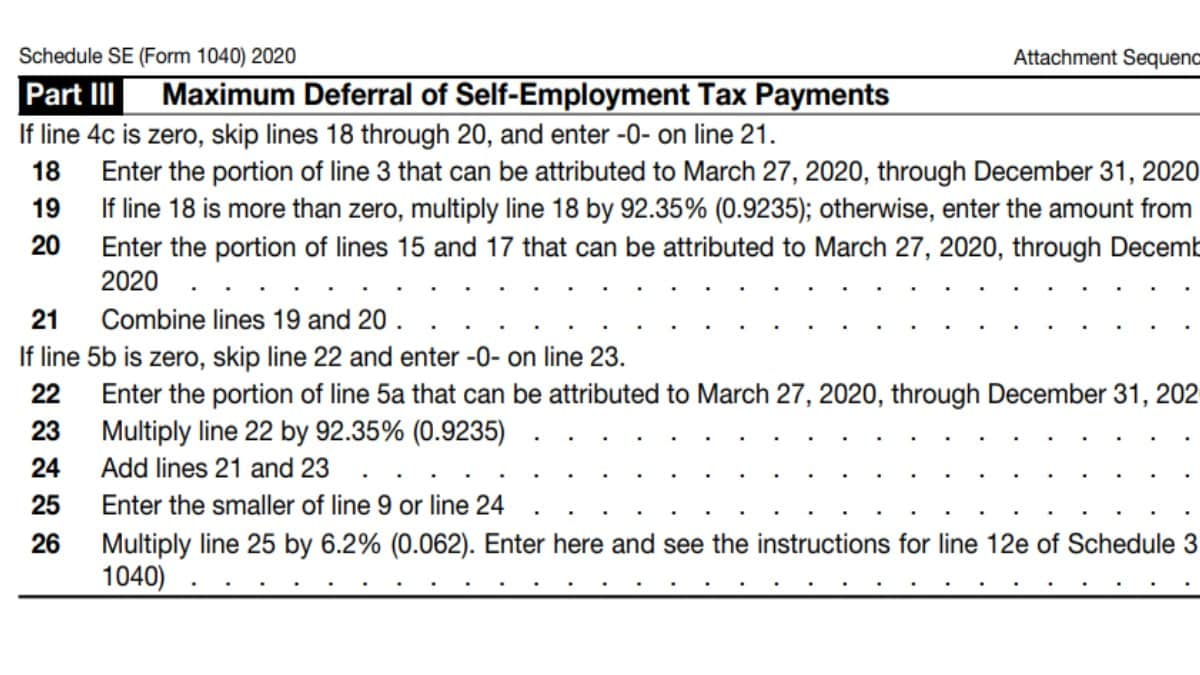

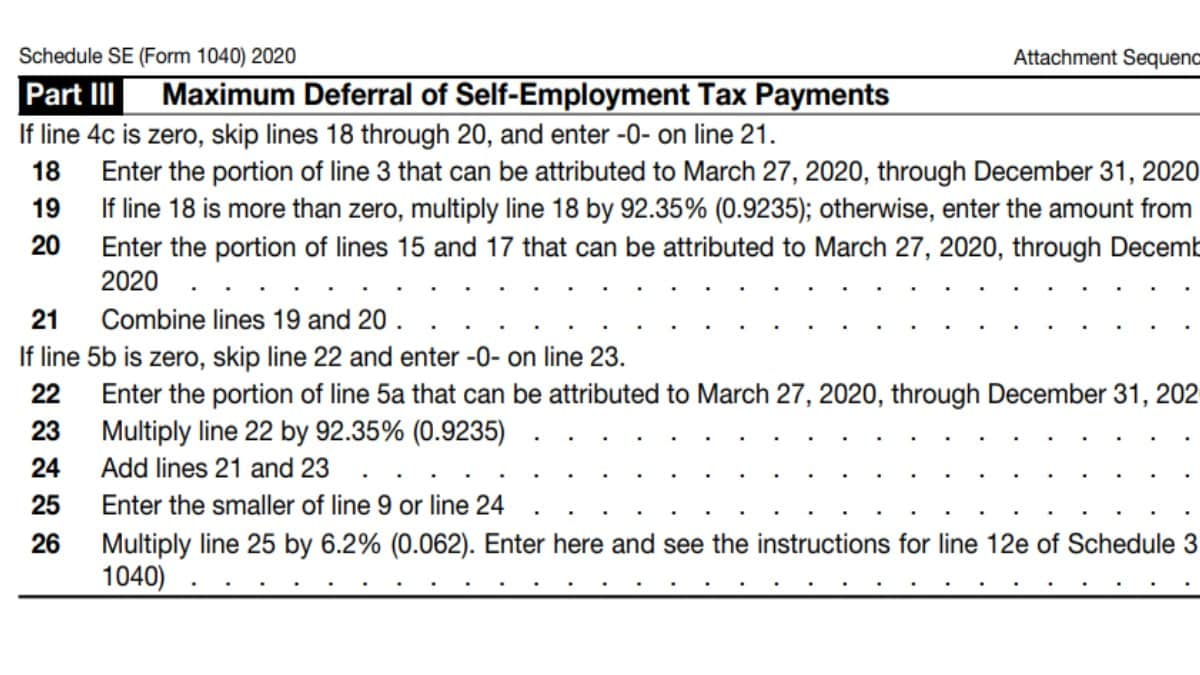

Benefit of Tax Deferral Calculator. Ad Avoid Confusion And Make Self-Employed Taxes Easier With Our Simple Step-By-Step Process. Under Section 2302 of the CARES Act a self-employed individual is able to defer 50 of the payment of Social Security Tax imposed on their net earnings from self.

Ad Avoid Confusion And Make Self-Employed Taxes Easier With Our Simple Step-By-Step Process. Self employment taxes are comprised of two parts. The Coronavirus Aid Relief and Economic Security Act allowed self-employed individuals and household employers to defer the payment.

Use this calculator to estimate your self-employment taxes. Ad Search For Info About Self employment tax deduction calculator. Once you know how much of your net earnings are subject to tax its time to apply the 153.

The self-employment tax rate is 153. Scroll to Tax relief related to COVID-19 and Show More. The IRS self-employment limits for the Social Security portion for 2020 is 137700 which is subject to 124 of the self-employment tax.

Discover Important Information About Managing Your Taxes. Instead earnings and any untaxed contributions are taxed at ordinary. The rate consists of two parts.

Calculated as Schedule C income minus the deduction for SE taxes. This amount will not be included in self-employment taxes owed on the 2020 return. To see how this works check out our Self-Employment Tax Calculator.

Social Security and Medicare. Roughly 9235 of your self-employment earnings will be subject to self-employment tax. 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance.

However if you are self-employed operate a farm or are a church employee. Social Security tax deferral. However it will need to be repaid.

If you have employees you can defer the 62 employer portion of Social Security tax for March 27 2020 through December 31 2020. Browse Get Results Instantly. 1 Taxes are assessed and paid.

High income individuals may be assessed an. COVID Tax Tip 2021-96 July 6 2021. Use Our TurboTax Tax Calculator And Uncover All Your Work-Related Deductions Today.

You will pay 62 percent and your employer will pay Social Security taxes of 62 percent on the first 128400 of. Use Our TurboTax Tax Calculator And Uncover All Your Work-Related Deductions Today. Up to 10 cash back Self-employment tax consists of Social Security and Medicare taxes for individuals who work for themselves.

Employees who receive a W-2 only pay half of the total. According to the IRS self-employed individuals may defer the payment of 50 percent of the Social Security tax imposed under section 1401 a of the Internal Revenue Code on net. This is your total income subject to self-employment taxes.

Unfortunately self-employed individuals cant defer their entire Social Security tax over the eligible deferral period. Estimate and compare the future value difference between a taxable product and a tax-deferred product. Return to the Deductions Credits section.

Instead they can only defer half of their tax burden. Normally these taxes are withheld by your employer.

Self Employed Fear Unaffordable Tax Bills As A Result Of Coronavirus Financial Times

![]()

5 Ways To Reduce Your Tax Bill When Self Employed Freelancer And Contractor Insurance Caunce O Hara

Payroll Tax Deferral How Will It Affect You Experian

Do Not Want To Do Self Employment Tax Deferral And

14 Tax Tips For The Self Employed Taxact Blog

How To Pay Your Deferred Self Employment Tax

Free 6 Sample Self Employment Tax Forms In Pdf

How To Defer Social Security Tax Covid 19 Bench Accounting

Can I Still Get A Self Employment Tax Deferral Shared Economy Tax

How The Pay As You Earn System Works An Employer S Perspective Low Incomes Tax Reform Group

What The Self Employed Tax Deferral Means Taxact Blog

What The Self Employed Tax Deferral Means For Your Self Employed Tax Clients Taxslayer Pro S Blog For Professional Tax Preparers

7 Easy Payroll Remittance Form Sample Payroll Payroll Taxes Form

What You Need To Know When Claiming Tax Relief For Self Employed Losses In 2020 21 Low Incomes Tax Reform Group

How Do I Tailor My Self Assessment Tax Return Youtube

Free 6 Sample Self Employment Tax Forms In Pdf

Max Deferral Line 18 Federal Income Tax Taxuni

Self Employed Tax Calculator Small Business Bookkeeping Business Tax Self Employment

What Is Self Employment Tax And What Are The Rates For 2019 Workest